Funding Regulations

Introduction

The federal government provides billions of dollars in grants to over 30,000 organizations annually. This investment of taxpayer dollars means that the federal government must set up strong controls over grant projects to ensure the proper use of public funds. It can be complicated and does take time to learn. Your knowledge will grow with experience and training. There may also be experts in your school district to help you.

When Congress created the GEAR UP program, they wanted to create partnerships that would sustain themselves. The result is the dollar-for-dollar match requirement. The total project cost is shared between federal and non-federal sources. GEAR UP programs need to collect and accurately document in-kind contributions of goods and services. When developing match opportunities, an eye should be kept toward developing community relationships that will perpetuate the goals and objectives of GEAR UP long after direct funding ceases. Such match helps ensure that local partnerships are created and that GEAR UP grant resources are being directed to communities.

Regulations

The federal policies that govern GEAR UP are diverse and sometimes confusing. You may find inconsistencies that come from government and agency policies trying to accommodate many unique grant programs. In GEAR UP, you are subject to a number of regulatory sources. When you come across conflicts or inconsistencies between the sources, generally you should begin with the GEAR UP statute, and then move down the hierarchy for answers. The following list provides a brief description of each of the major policy sources:

| Source |

Description |

| Statute |

A statute is the federal law that authorizes or governs a program. In the case of GEAR UP, the term statute refers to the program legislation found in Title IV of the 1998 Amendments to the Higher Education Act (HEA) of 1965 [P.L. 105-244]. The statute sits at the top of the hierarchy but affords the Secretary of Education the authority to set program-specific policies, which are commonly known as “program regulations.” The statute only broadly defines how the program should operate. |

| Program Regulations |

Program regulations provide additional guidance when the statute is silent or vague on an issue. They provide details that govern the application competition, dictate how programs will be implemented, and other administrative details. There are three types of regulations that you should become familiar with:

- EDGAR

- GEAR UP program regulations

- OMB Circulars

|

| EDGAR |

The Education Department General Administrative Regulations (EDGAR) set broad administrative policies that impact nearly all grant programs funded at the USDOE. The regulations are published in Title 34 of the Code of Federal Regulations (CFR). The pertinent sections of EDGAR to your grant administration are 34 CFR parts 75, 76, 77, 79, 81, 82, 84, 86, 97, 98, and 99.

Go to EDGAR |

| GEAR UP Program Regulations |

Whereas EDGAR sets broad agency-wide policies, the GEAR UP program regulations address the very unique administrative matters associated with GEAR UP. GEAR UP program regulations are published in 34 CFR part 694. Other parts relevant to GEAR UP are 206, 642, 643. |

| OMB Omni Circular |

The Omni Circular was approved by the Office of Management and Budget (OMB) on December 26, 2013, and provides 26 federal agencies with instructions and guidance on a wide variety of administrative issues of interest to the executive branch. The Circular is also referred to as Uniform Administrative Requirements or Uniform Guidance. The Omni Circular will affect your day-to-day decision-making because EDGAR cites the Circular as regulation. Thus, much of the discussions in the grant administration world will revolve around the circular, as it defines cost principles, administrative requirements, and audits. An additional circular relevant to administration of the GEAR UP grant is A-21, Educational Institutions.

Go to OMB Circulars |

Fiscal Agent Policy and Procedure

In addition to understanding federal requirements, you are expected to follow the policies of the fiscal agent of the grant (Utah State University, and the GEAR UP administrative team). The University and administrative team have additional policies they must follow to comply with state and federal law and USU policies. It is important to rely on the University and administrative team staff when the federal regulations aren't clear on an issue. You also must follow University and administrative team reporting guidelines and budget categories.

Time & Effort Reporting

Develop a process for collecting time and effort sheets from teachers, staff and volunteers regularly and accurately. Federal regulations require that every GEAR UP staff whose salary is supported in full or in part need to document the time, effort and activities during any given pay period. When you use in-kind personnel contributions as match, they have to fulfill the same reporting obligations as if they were receiving federal funds, including signed time and effort forms.

Allowable Costs

Sound fiscal GEAR UP administration begins with understanding what types of expenses can be paid for with federal funds. Allowable costs are those expenses that are specifically permitted (or not explicitly prohibited) by the laws, regulations, principles and standards issued by the USDOE, USU, and other authoritative sources.

To help you decide if costs are allowable or not, ask these questions: Is the expense:

- Reasonable and necessary: reflecting an action that a prudent person would take and generally recognized as necessary for the school or partner to accomplish a workplan activity, guided by established institutional policies and practices.

- Allocable: applied in proportion to relative benefits, as approximated through reasonable methods.

- Allowable: connected to the required or permissible services of the USU STARS! GEAR UP program.

- Consistent: treating anything not allowed by the fiscal agent (USU), the school or partner organization as not allowed by GEAR UP.

- Compliant: follows reporting requirements, limitations and exclusions as stated in federal cost principles, these guidelines, and the annual subcontract/amendment.

Supplement But Not Supplant

GEAR UP regulations require that GEAR UP funds supplement-not-supplant school or district monies. GEAR UP funds are intended to build the capacity of school districts to create a college going culture. Therefore, GEAR UP funding may be used to enhance (supplement) what is already in place or to create new activities. GEAR UP funds cannot be used to replace (supplant) other federal, state, or local funding.

Below are some examples:

- For the last five years, your school has paid for a career exploration software license. This year, the school needs new PE equipment so you have been asked to pay for the software license with GEAR UP funds to free up funding for PE equipment. This is supplanting - and is not allowed.

- For the last several years, your school has annually purchased $500 of new library books. This year you have been asked to use GEAR UP funds to pay for the books. This is supplanting - and is not allowed.

- For the last two years, your school has been unable to purchase any curriculum enhancement materials for math classes, including an essential software package, because of budget cuts. You have been asked to purchase this software with GEAR UP funds this year. This is supplementing - and is allowed because without GEAR UP funding, your school would not be able to make this purchase.

Utah State University STARS! GEAR UP Model

GEAR UP funds may be used to pay for activities that support the Utah State University STARS! GEAR UP Goals and Objectives, as outlined in the School Sub-Award Agreement, Scope of Work, and the Utah State University STARS! GEAR UP Career and College Ready Benchmarks.

When planning for activities and expenditures, schools must follow the guidelines below:

Funds may be used to support activities for all students in the GEAR UP Cohort. If you opt to include additional students in any GEAR UP sponsored activities, or share in using GEAR UP purchased supplies, equipment, etc., costs should be covered proportionately from other funds.

New Students: New, eligible students may be added at any time throughout the grant period. Once a student is deemed eligible, they remain eligible for the remainder of the grant period.

Audits

USU and subcontractors are subject to OMB Omni Circular (Uniform Administrative Requirements, or Super Circular) 2 CFR 200, Subpart F Audit Requirements. The Omni Circular contains guidance for obtaining consistency and uniformity among federal agencies for the audit of states, local governments and non-profit organizations expending federal funds. The circular also codifies in this subpart the requirements for states, local governments and non-profit organizations that expend greater than $750,000 per year in federal funds to have a “single audit” conducted in accordance with the Circular. In other words, there will be a GEAR UP audit for which you must be prepared.

The Omni Circular is especially important for GEAR UP recipients since it provides guidance regarding grantees responsibilities. These responsibilities include maintaining adequate internal controls for the expenditure of federal funds, expectations for financial reports and reporting systems as well as requirements for documentation and records management.

Sub-grantee responsibilities

- Identification of federal awards received and expended in its accounts

- Maintenance of adequate internal controls over federal programs

- Compliance with applicable laws, regulations and provisions of grant programs

- Preparation of appropriate financial statements, including schedule of expenditures from federal awards

- Ensure audits are properly performed and reports submitted when due

- Follow up and corrective action on audit findings

- Prompt reporting of expenses and cost share

- Ensure your monitoring activities comply with your contract to ensure federal funds are used for authorized purposes and in accordance with laws/regulations/grant agreements

USU responsibilities

- Ensure sub-grantee monitoring complies with sub-grantee contracts to ensure federal funds are used for authorized purposes and in accordance with laws/regulations/grant agreements

- Advise sub-recipients of applicable laws, regulations and provisions of grant agreements

- Monitor sub-recipient activities to ensure sub-recipients subject to the Omni Circular have met audit requirements

- Issue a management decision on audit findings within six months

- Determine whether a sub-recipients audit necessitates adjustments to its own records

- Require sub-recipients to grant USU and auditors necessary access to records and financial records

Recent Areas of Focus for Federal Audit

- Time and effort reporting

- Financial and technical reporting

- Sub-recipient monitoring

- Cost sharing/matching documentation

As a sub-grant recipient you need to ensure compliance with federal regulations, laws and grant requirements. USU is constantly monitoring its systems and internal controls and encourages grant recipients to do the same. We recommend you:

- Review your time and effort reporting systems and strengthen as needed

- Review your written policies and procedures to ensure they are accurate and up-to-date

- Review your cost sharing commitments and methods for tracking

- Review your financial and programmatic reporting systems and work with agencies to establish reasonable deadlines

Sub-recipient Monitoring

The monitoring of contracts awarded to sub-recipients includes state and/or federal funds from state departments, agencies and commissions associated with GEAR UP. This is done to ensure financial records are being reported and maintained in a manner consistent with federal reporting requirements. The monitoring process includes the following areas:

- Review of approval documentation for program activities and expenditures

- Review for compliance with the monetary services outlined in the grant contract

- Review of audit procedures and prior audit results

- Personnel cost documentation and allocation methodology

- Fiscal record reconciliation and documentation

- Data reporting system usage and data retention

Allowable and Unallowable Costs

Common GEAR UP Costs

(Sources: GEAR UP Statute, EDGAR, OMB Circular A-21, OMB Omni Circular)

The following list may help you determine whether your program expenses are allowable or not. It includes costs that are commonly incurred in GEAR UP, or are the subject of frequent questions, or discussions about their permissibility

NOTE: Just because a cost is interpreted as being allowable under the OMB cost principles, it is not guaranteed that you will be able to make that expenditure. This may happen when, for example, a cost identified as allowable under the circular may be disallowed in program regulations or statute, or fail to pass the USDOE2s judgment that it is justified, allowable, or reasonable.

| Type of Cost | Allowability | Notes |

|---|

| Advertising and Public Relations Costs |

Generally unallowable |

The OMB cost principles define advertising costs as the expenses associated with the costs of advertising media (magazines, newspapers, radio and television, direct mail, exhibits, electronic or computer communication) and associated administrative costs. |

| Advisory Councils |

Generally unallowable |

Costs incurred by advisory councils or committees are allowable as a direct cost when authorized by the awarding agency, or as an indirect cost where allocable to the GEAR UP award. |

| Alcoholic Beverages |

Unallowable |

|

| Commencement and Convocation Costs |

Unallowable |

For education institutions, costs associated with commencement and convocations are disallowed, but costs associated with GEAR UP activities that take place during commencement events may be allowable under student activity costs if approved as part of your grant agreement. |

| Communication Costs |

Allowable |

Costs incurred for telephone services, local and long distance telephone calls, postage, messenger, electronic or computer transmittal services and the like are allowable. However, you will need to check if these expenses are captured in your indirect costs. |

| Compensation (Salaries, Wages & Fringe Benefits) |

Allowable |

Personnel costs such as salaries, wages and fringe benefits are allowable to the extent that the total compensation to individual employees conforms to the established policies of the institution, consistently applied, and provided that the charges are for work performed directly on GEAR UP activities as outlined in the sub-grantee workplan.

Fringe benefits costs should be in line with institutional policies regarding: annual leave, sick leave, military leave, and employer contributions or expenses for social security, employee insurance, workmen's compensation insurance, and tuition or remission of tuition for individual employees. |

| Consultants & Contracts |

Allowable |

EDGAR states that costs associated with consultants are allowable if there is a need in the project for the services and the grantee cannot meet that need by using an employee rather than a consultant. |

| Entertainment Costs |

Unallowable |

Costs of entertainment, including amusement, diversion, and social activities and any costs directly associated with such activities (such as tickets to shows or sports events, recreational activities such as swimming, meals, lodging, rentals, transportation, and gratuities) are unallowable. Costs that might be otherwise considered entertainment which have a programmatic purpose and are authorized either in the approved budget for the Federal award or with prior written approval of the Federal awarding agency may be allowable.

Be sure to distinguish these unallowable expenses from similarly worded and allowable student activities, meetings, and conferences that are approved as part of your grant agreement. |

| Equipment |

Allowable, but not an expected GEAR UP expense |

Equipment means an article of nonexpendable, tangible personal property having a useful life of more than one year and for GEAR UP accounting purposes, has a per-unit cost equal to or greater than $5,000. Items less than $5,000 per unit, including computers, are classified as Supplies (see below).

The title (documented ownership) of the equipment vests in the grantee and may be used for other projects as long as that use does not interfere with the terms of the grant award. |

| Fines and Penalties |

Unallowable, with exceptions |

Costs resulting from violations or failure of the fiscal agent to comply with federal, state, and local or foreign laws and regulations are unallowable, except when incurred as a result of compliance with specific provisions of the sponsored agreement, or instructions in writing from the authorized official of the sponsoring agency in advance of such payments.

Late fees, including late fees for registrations, and interest charges on credit cards are unallowable. Student fines are also unallowable. |

| Fund Raising |

Unallowable |

Costs of organized fund raising are not allowed. |

| Goods or Services for Personal Use |

Unallowable |

Costs of goods or services for personal use of the governmental unit's employees are unallowable regardless of whether the cost is reported as taxable income to the employees. |

| Lobbying |

Generally unallowable, with exceptions |

Federal funds cannot be used to:- Influence the outcome of referendum, initiative, or similar procedure, through in-kind or cash contributions, endorsements, publicity, or similar activity.

- Support a political party, campaign, or political action committee.

- Influence the introduction, enactment or modification of state or federal legislation through direct or grassroots lobbying.

However there are a few exceptions, including:- Technical and factual presentations on topics directly related to the performance of a grant, contract, or other agreement.

- Efforts to influence state legislation in order to directly reduce the cost, or to avoid material impairment of the institution's authority to perform the grant, contract, or other agreement.

- Any activity specifically authorized by statute to be undertaken with funds from the grant, contract, or other agreement.

|

| Meetings and Conferences |

Allowable, with exceptions |

Costs of meetings and conferences approved by the GEAR UP Program Officer, the primary purposes of which are the dissemination of technical information, are allowable. This includes costs of meals, transportation, rental of facilities, speakers' fees, and other items incidental to such meetings or conferences. Be aware of restrictions pertaining to entertainment costs |

| Memberships, Subscriptions, & Professional Activity Costs |

Allowable, with exceptions |

Costs associated with memberships in business, technical, and professional organizations are allowable. In addition, subscriptions to business, professional, and technical periodicals are allowable.

Please note that the Omni Circular makes the following exceptions:- State entities can use federal funds for membership in civic, community, and social organizations that are allowable as a direct cost with the approval of the USDOE.

- State entities cannot use federal funds for membership in organizations substantially engaged in lobbying.

|

| Providing Donations and Contributions |

Unallowable |

Contributions or donations (including cash, property, and services) are unallowable costs.

This should be distinguished from the match. GEAR UP may receive donations, contributions, or services under the GEAR UP match guidelines. |

| Publications and Printing |

Allowable |

Publication costs—including the costs of printing, distribution, promotion, mailing, and general handling—are allowable federal costs if they are allocable to project objectives. If not, any publications or printing should be paid for by institutional or indirect funds. |

| Public Relations Costs for GEAR UP |

Potentially allowable under certain circumstances |

- The activity is part of your approved application.

- You are communicating with the public and press pertaining to specific activities or accomplishments that result from your grant performance (these costs are considered necessary as part of the outreach effort for the sponsored agreement).

- You are conducting general liaison with news media and government public relations officers, to the extent that such activities are limited to communication and liaison necessary to keep the public informed on matters of public concern.

|

| Reasonable Advertising Costs for GEAR UP |

Potentially allowable under certain circumstances |

Allowable when recruiting and advertising for vacant GEAR UP staff positions in a manner that is acceptable and standard for the hiring entity.

The term public relations is defined as activities dedicated to maintaining the image of the institution/governmental agency or maintaining or promoting understanding and favorable relations with the community or public at large or any segment of the public. |

| Rental Cost of Buildings and Equipment |

Allowable |

With stipulations, rental costs are allowable to the extent that the rates are reasonable in light of such factors as: (1) rental costs of comparable property, if any; (2) market conditions in the area; (3) alternatives available; and, (4) the type, life expectancy, condition, and value of the property leased. Rental arrangements should be reviewed periodically to determine if circumstances have changed and other options are available. |

| Severance Pay |

Allowable |

Costs of severance pay, for personnel whose services have been terminated are allowable only to the extent that such payments are required by law, by employer-employee agreement, by established policy that constitutes in effect an implied agreement on the institution's part, or by circumstances of the particular employment. |

| Student Activity Costs |

Generally allowable, with exceptions |

Costs incurred for intramural activities, student publications, student clubs, and other student activities, are unallowable, unless specifically provided for in the grant agreement. |

| Supplies |

Allowable |

Costs incurred for supplies to carry out the grant are allowable. Supplies have a per-unit cost of less than $5,000. Computers, peripherals, etc. are considered supplies. |

| Travel costs |

Allowable |

Travel costs are the expenses for transportation, lodging, subsistence, and related items incurred by employees who are in travel status on official business of the institution. Travel outside of the United States requires prior approval.

Travel costs also may be incurred in relation to local events for students, parents or professionals participating in programs authorized by the GEAR UP statute. Please see the USU STARS! GEAR UP Travel Guidelines for additional guidance. |

Eligible budget transfers

Throughout the academic year, school districts may identify priorities and activities aligned with USU STARS! GEAR UP goals and objectives not originally included in the annual USU STARS! GEAR UP workplan and/or budget. In addition, some planned activities may come in under cost, making funds available for additional activities related to the program goals and objectives. As these budget transfer needs are identified, the school district must submit a formal request to the USU STARS! GEAR UP Administrative Team through e-mail to the Business Officer. Requests should include specific information regarding the amount of funding, by budget line, requested for transfer to identified budget lines. Budget transfer requests should be infrequent and are reviewed by the USU STARS! GEAR UP Administrative Team on a case-by-case basis. If approved, the USU STARS! GEAR UP Administrative Team will issue a formal approval via e-mail of the transfer.

Cost & Supply Allowances

| Description | Amount | Purpose |

|---|

| Clothing items w/ GEAR UP on it. Any printing/ setup charges must be included. |

Up to $20 each |

Students, staff, chaperones to wear on field trips, school events, special programs, community service and other events to promote GEAR UP, teamwork, and safety (on field trips). Limited to 3 times per cohort duration (7 year period). |

| Pencils/Pens |

Up to $1 each |

Student Activities/Workshops |

| Magnets |

Up to $1 each |

Student Activities/Workshops |

| Stickers |

Up to $1 each |

Student Activities/Workshops |

| School Supplies (binders, folders, paper, bookmarks, highlighters, lanyards, markers, calculators, and other school supplies) |

Up to $20 per student per year |

Student Activities/Workshops |

| Hats or bags w/ GEAR UP on it. |

Up to $10 each |

Student Activities/Workshops |

| Career or educational books |

Up to $20 each |

Student Activities/Workshops |

| Educational CD's |

Up to $10 each |

Student Activities/Workshops |

| Educational DVD's |

Up to $10 each |

Student Activities/Workshops |

| Flash Drives |

Up to $10 each |

Student Activities/Workshops |

| Water Bottles |

Up to $5 each |

Student Activities/Workshops (for safety purposes only) |

Notes:

- Gift Cards are not allowable.

- Student incentives and awards (treats, drinks, food, headphones, flashdrives, trophies, etc.) are not allowable.

Meal, Beverage, and Snack Allowances

Food and beverages may be offered to participants in conjunction with GEAR UP sponsored events and activities where participants are exposed to GEAR UP information or completing GEAR UP objectives. USU STARS! recommends offering 'refreshments' or 'snacks' at events, although healthy meals may be provided on occasion and with prior approval. Please use the guidelines below to better understand when food and beverages might be permitted; approval is required for every food request through the KissFlow system and USU STARS! retains the right to decline purchases viewed as unnecessary or excessive.

| Description |

Amount |

Purpose |

| Refreshments |

Up to $4 per participant |

Events include family/parent night events, annual/kickoff and closing events |

| Meals* |

Up to $12 per student or chaperone per meal |

Campus visits or field trips |

| Light meal, modest not a full-course meal** |

Up to $6.50 per participant |

Events that target families like family/parent nights and annual kickoff and closing events |

| Healthy and nutritious snacks |

Up to $2 per day per student |

Events include field trips, college visits, pre-college tests/placement tests |

| Beverage and refreshment |

Up to $5 per person per event |

Advisory meetings, volunteer meetings, chaperone meetings |

* Note: While we will allow meals up to $12 for off middle/high-school campus activities (student should be considered in travel status i.e. away from school of enrollment), we encourage coordinators to still find meals closer to $10/person when possible.

** Meals can be matched up to $6.50/meal, for funds spent by schools. If meals are donated at a rate of over $6.50/meal, the full amount can be matched. If events are serving more than GEAR UP students/families costs must be split by attendance. This should be indicated on the KissFlow Food Request form.

Unallowable Food Purchases

| Description |

Amount & Purpose |

| Staff meals |

Food is not allowed for staff or employees for regular work activities. |

| School Staff professional development activities |

Meals also will not be provided for school staff meetings or professional development activities outside meals covered by registration. |

| Large or multi-course meals |

A large or unhealthy meal is not allowed for family events. Full course dinner might be defined as consisting of multiple dishes, or courses. All meals will require prior-approval by USU STARS! |

Perishable leftover food from events should be sent home with GEAR UP families and students whenever possible. In the event of excess, it can be distributed to GEAR UP students at school the following day. If neither of these are possible, it can be donated to a local homeless shelter. Non-perishable food should be kept for another GEAR UP event.

Other Allowable Student Expenses

GEAR UP allows expenses related to dual credit options, credit recovery, student camps, placement tests, and college application fees. Use the following guidelines when planning for these expenses

| Description |

Amount |

Purpose |

| AP tests, Running Start books, College in the High School costs or similar expenses. |

Allowable |

Activities associated with academic college credit |

| Individual student camps, on a college campus. |

Request Pre-Approval |

Academic support or enrichment |

| SAT or ACT tests |

Published amount and allowable only if student is not eligible for a waiver |

Pre-college tests |

| College Placement Tests (ASSET, Compass, etc.) |

Published amount when no waiver is available |

Placement tests |

| College application fees |

Published amount (less $15) when no waiver is available |

Fee reimbursement

Instructions and form |

Invoicing Guidelines

Collecting and documenting expenses on an ongoing basis is wise, efficient, and much less stressful than attempting to catch up or go back and document it. When collected as part of the day-to-day program, it is easier to record accurately and monitor regularly. Breaking down a grant's expenses on a monthly basis makes this task manageable and attainable. Be sure that you confer with your District Financial Officer and/or Building Administrators on all budgetary processes prior to submitting your invoice for reimbursement.

When considering whether or not goods or services qualify as an allowed expense, refer to the Common GEAR UP Costs section in Section 3: Expenditure & Reimbursement Procedures. Generally, to determine if a good or service qualifies as an allowed expense, you should ask yourself:

- Could I pay for this item or service using my federal GEAR UP funds?

- Does it support the GEAR UP objectives?

- Is it legal and ethical?

- Does it pass the “headline test”? (Would you want this to be reported in newspapers?)

Instructions for Reimbursement

There are five parts required each month in order for the district to be reimbursed for expenditures:

- The Invoice Form

- Invoices must be submitted monthly. Bi-monthly, quarterly or other submission schedules are not allowed.

- Complete and submit an invoice by the 15th of each month for the preceding month's expenditures.

- Each invoice should only include expenses for one calendar month (please do not mix months).

- Include the USU Sub-award number on each invoice.

- See Step 3 and sample Invoice.

- The Expenditure Detail Form

- The Expenditure Detail Form, or substitute Excel spreadsheet, must include a complete description of the purpose of the expenditures.

- See STEP 1 and sample Expenditure Detail Form.

- Back-up documentation and receipts of expenditures

- See STEP 1 and sample back-up documentation.

- The Monthly Match Summary

- The Monthly Match Summary, or substitute Excel spreadsheet must include a complete description of the purpose of the cost share.

- See STEP 2 and sample of Monthly Match Summary

- The required cost share documentation (including the In-Kind Contribution of Teacher or Staff Time and Effort Report, the Volunteer Match Certification Form, and the Match Contribution of Goods and Services Statement).

- See STEP 2 and samples of In-Kind Contribution of Teacher or Staff Time and Effort Report, the Match Contribution of Goods, and the Volunteer Certification Match Form.

- When submitting the Invoice packet to USU, please assemble the documents in the following order:

- The Invoice

- The Expenditure Detail Form

- The back-up documentation for Expenditures

- The Monthly Match Summary

- Cost Share Documentation

- Restricted Indirect Cost Rate - If in question contact the Business Offi cer at Utah State University

Mail, fax, or email invoice packets requesting reimbursements to:

Cohort 2 & 3

ATTN: Penny Richens

Utah State University

USU STARS! GEAR UP

2805 Old Main Hill

Logan, UT 84322-2805

penny.pritchard@usu.edu

Cohort 4

ATTN: Shay Workman

Utah State University

USU STARS! GEAR UP

2805 Old Main Hill

Logan, UT 84322-2805

shay.workman@usu.edu

Records Retention Requirement: The sub-contractor must retain itemized records of all expenditures for seven years after final payment is remitted. The records may be subject to program review or audit at any time

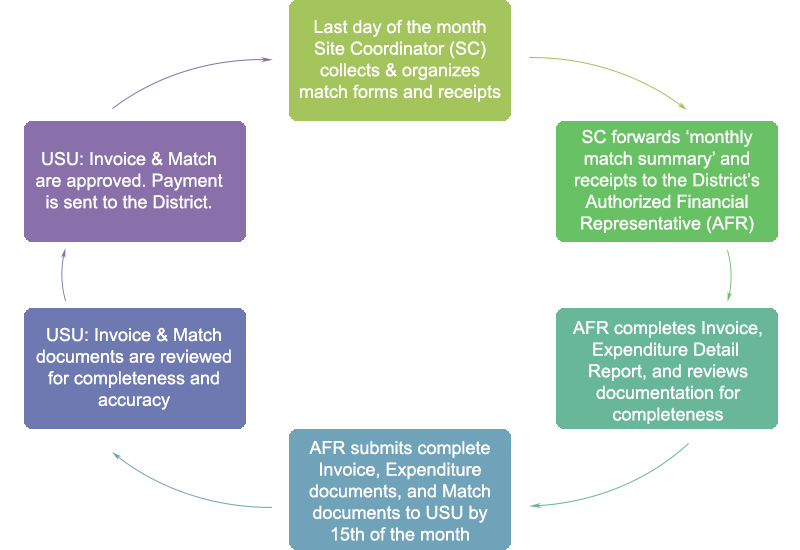

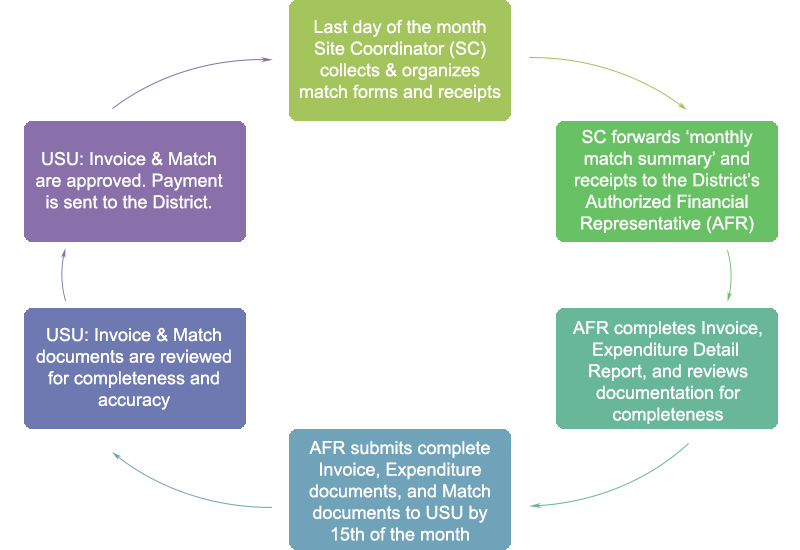

Invoicing Life Cycle

STEP 1: Collect Expenditure Backup Documentation and Complete the Expenditure Detail Form

EXPENDITURE DETAIL CATEGORIES: When preparing the Expenditure Detail Form, please adhere to the following guidelines for categorizing all expenditures. The list also includes the backup documentation required to be maintained for seven years by the school/district. Each claimed expense must be accompanied by documentation.

View Sample Expenditure Detail

View Sample Backup Documentation

Direct Costs

- Salaries & Wages

- Salaries or wages for staff paid from GEAR UP funds for the grant fiscal year.

Backup Documentation Required: Include a payroll report with detailed compensation and benefits information for GEAR UP-paid staff. Sort the report by payee.

- Benefits

- Staff benefits paid for with GEAR UP funds for the grant fiscal year.

- Costs for mandatory employer deductions.

Backup Documentation Required: Include a payroll report with detailed compensation and benefits information for GEAR UP-paid staff. Sort the report by payee.

- Travel and Professional Development

Review the GEAR UP Travel Guidelines prior to scheduling any travel and incurring any travel expenses. Submit all documentation for each trip in a single package, do not distribute across several months.

- Staff travel

- Reimbursements for staff travel paid for GEAR UP sponsored events.

- Reimbursement for approved professional development travel expenses, registration, and other fees.

- Travel expenses will be paid in accordance with district policies. Costs may not exceed state per diem rates for mileage, lodging, and meals.

- Please submit each instance of travel as a complete package, do not spread travel reimbursements across multiple invoices.

- Student Transportation

- Costs for district vehicles, including driver time, for GEAR UP events.

- Reimbursement rate at USU is currently $0.50 per mile (effective 1/1/20) for privately owned cars.

- Reimbursement rate is per established district rates for other vehicles, including SUVs and buses. Districts must provide verification of rates to the management team to charge more than $0.50 per mile (effective 1/1/20).

Backup Documentation Required: Backup documentation is required to be submitted to Utah State University. This may be in the form of copies of detailed travel vouchers, receipts, travel logs, or invoices. Original records must be kept by individual schools/districts for seven years after final payment is remitted.

- Other Direct Costs

- Cost of consumable supplies, including office supplies, photocopies, postage, and other materials required and necessary for GEAR UP operations.

- Cost of instructional materials, guest speakers, and other related items as allowed by GEAR UP to ensure that students meet the College and Career Ready Benchmarks.

- Costs for standardized tests when students do not qualify for waivers.

- Costs for college visits, job shadows, and educational field trips, including meals for participants (approximately $8 per participant per meal), and fees for related educational activities. All trips must be pre-approved.

- Entertainment, clothing, and souvenir expenses are NOT allowable.

Backup Documentation Required: Backup documentation is required to be submitted to Utah State University. These can be in the form of copies of detailed receipts or invoices. A credit card summary receipt is NOT acceptable. All records submitted for reimbursement must be kept by individual schools/ districts as supporting documentation. Purchase orders, reservation confirmations, etc. are not sufficient documentation and will not be accepted without accompanying receipts.

- Indirect Costs

- Consistent with section 200.414 of the Omni Circular, all grant recipients are limited to a maximum indirect cost rate of ten percent of a modified total direct cost base or the amount permitted by its negotiated restricted indirect cost rate agreement, whichever is less. This rule applies to grantees under programs with a statutory requirement prohibiting the use of Federal funds to supplant non-Federal funds, and to the sub-grantees under these programs. GEAR UP legislation contains a requirement prohibiting the use of GEAR UP funds for supplanting. As outlined in section 200.414 of the Omni Circular, therefore, LEAs must use the negotiated restricted indirect cost rate when developing their budget.

Backup Documentation Required: The federally negotiated indirect cost rate agreement should be submitted to USU on an annual basis. The indirect cost rate agreement “Schedule M” can be found online at https://www.schools.utah.gov/financialoperations/reporting

NOTES

Internet Purchases: When purchasing and/or paying for items online, it can be particularly challenging to get the correct backup documentation. It is important that you print the final invoice of your purchase showing what was purchased, the date the item was purchased, payment method used, and the detailed costs. Order confirmations, order summaries, etc. are not invoices and will not be accepted as backup documentation.

Pre-Payment: Per State of Utah regulations, GEAR UP will not reimburse for items or services that have not been received by the school district. You must have received all goods and services prior to submitting for reimbursement. The only exceptions are:

Conference registrations: Airfare or other transportation that must be pre-purchased.

Credit Card Statements and Receipts: All purchases require a detailed receipt as backup, therefore neither the summary receipt that is given when you make a credit card payment, nor the credit card statement, are accepted as backup.

Matching the Expenditure Detail Form with Receipts: Each purchase listed on the Expenditure Detail Form must be accompanied by a detailed receipt as backup. Review your form and receipts for a case-by-case match prior to submitting your invoice. Expenses without matching receipts, and receipts that are not detailed on the form, will not be approved. Receipts that are illegible, or which have portions obscured, will not be approved.

Alternative Expenditure Detail Form: The pdf version of the Expenditure Detail Form is often too short to include all the expenses for a month. You may submit an Excel spreadsheet that follows the same format as the Expenditure Detail Form as a substitute.

Step 2: Collect Cost Share Documentation and Complete The Monthly Match Summary

All Site Coordinators and Authorized Financial Representatives are required to complete the Cost Share Training.

Remember that if a cost is unallowable as an expenditure, it is not an allowable match.

View Sample Match Summary Form

View Sample Backup Documentation for Cost Share

View Sample Match Contribution of Goods Statement

Match Documentation Process: Each month, LEAs must submit documentation of their effort to meet the USU STARS! GEAR UP matching requirement. Matching documentation must be mailed/emailed along with the Invoice by the 15th of each month. Matching documentation includes four forms: Monthly Match Summary Form, Match Contribution of Goods, In-Kind Contribution of Teacher or Staff Time & Effort Report, and the Volunteer Effort Certification Match Form. A description of each form is provided below:

- Monthly Match Summary Form: This form provides an overview of the match for the reporting month. Each line should be supported by an In-Kind Match Form. The pdf version of the Monthly Match Summary Form is often too short to include all the expenses for a month. You may submit an Excel spreadsheet that follows the same format as the Monthly Match Summary Form as a substitute.

- Match Contribution of Goods Statement: This form should be filled out by any partner or donor providing goods as match to a school/district of the USU STARS! GEAR UP grant. The form must be completed and signed by both the donor and the Authorized School Representative.

- In-Kind Contribution of Teacher or Staff Time & Effort Report: This form should be completed by school/district employees who contribute time to the USU STARS! GEAR UP project. Administrators and others who “flat rate” their time and effort as a match must also sign this form each month. Please refer to matching guidelines for qualified activities.

- Volunteer Effort Certification Match Form: This form should be filled out by any person (other than teachers or district staff) providing in-kind services as match to a collaborator of the USU STARS! GEAR UP grant. The form must be completed and signed by both the donor and the Authorized School Representative. Volunteer matches will always be at the volunteer rate unless the donor is performing services in his/her official capacity.

- Matching Receipts and Reports to the Monthly Match Summary Form: Just as with expenditures, each matching good or service listed on the match summary form must be accompanied by a detailed receipt or time and effort report as backup. Review your form and receipts for a case-by-case match prior to submitting your invoice. Goods and services without matching receipts, and receipts that are not detailed on the summary form will not be approved.

Step 3: Complete the Invoice

View Sample Invoice

The following are the sections that must be completed on the Invoice by the school district:

- LEA Name: Name and address of the contracting school district. Use the address where you want the payment sent.

- Subaward Number: The assigned subaward number.

- Vendor's Certification: Signature and title of the contractor's authorized signatory. Each school district may determine the authorized signatory.

- Date: The date the invoice was prepared. (Note: This date may not be prior to the date any expenses on the invoice were incurred. (If any revisions have taken place, you must enter the date that the invoice was updated and mark the invoice as “Revised”.)

- Descriptions and Amounts of Expenditures and Cost Share: The invoice should reflect only the five budget categories detailed on the invoice. Submit in the same order as on the sample. Each expense submitted for reimbursement must be included on the Expenditure Detail Form and accompanied by backup documentation. All backup documentation must also be maintained by the school/district.

NOTES

Budget Balance Spreadsheet: On a monthly basis, school districts will receive a budget balance spreadsheet from the USU STARS! GEAR UP central office that outlines approved expenditures to date and remaining USU STARS! GEAR UP funds.

USU STARS! GEAR UP Conference Travel Guidelines

To provide adequate program supports, improve budgeting, allow additional travel funds to support student representatives, and increase exposure to the GEAR UP program, the following conference travel is allowed:

Administrative Team

Project Directors - National and Capacity Building annually

Program Coordinators - Capacity Building or National; GEAR UP West annually

Business Assistants - as approved by Project Director

Data Analysts - National or Capacity Building; GEAR UP West annually

Staff Assistants/Students - as approved by Project Director

Administrative teams also should consider attending other conferences that are a better fit for project needs (First Year Experience, Budget, etc.) instead of either the Capacity Building or national conference.

Education Partners

Site Coordinators - Capacity Building, National or GEAR UP West (Total of 7 conferences across all projects)

Administrators, Counselors, Teachers - Capacity Building, National or GEAR UP West (1 conference per person across all projects; individual can return to conference with approval of Project Director after 5 years and if covered by new grant)

Students - as needed (1 per person) accompanied by one chaperon that is either a parent of teacher who has not previously attended a GEAR UP conference.

While Site Coordinators and school administrators are encouraged to attend conferences to gain skills and awareness of GEAR UP, we do expect all schools to treat travel as with all GEAR UP expenditures and keep expenses necessary and appropriate. Schools are not to send representatives to multiple conferences in a year without approval of project coordinators. Conferences can be helpful in getting buy in from school administrators and learning best practices; approval for an administrator, teacher, or counselor to attend a conference more than once in the grant cycle must be approved by project directors. Schools should each consider if funds would be better used providing direct services to students, and administrators, counselors, and teachers should plan on attending regional or state professional development opportunities over the National conference or Capacity Building and should consider conferences that might be more fitting to school needs.

Regarding travel procedures, USU STARS! GEAR UP follows USU policy, but defers to district policy for all schools and coordinators.

Go to USU Travel Procedures